ホーム > 税金 > 固定資産税 > 固定資産税(概要) > がいこくのかた(こていしさんぜい) > FIXED PROPERTY & CITY PLANNING TAX

FIXED PROPERTY & CITY PLANNING TAX

最終更新日:2024年12月4日

ここから本文です。

FIXED PROPERTY & CITY PLANNING TAX

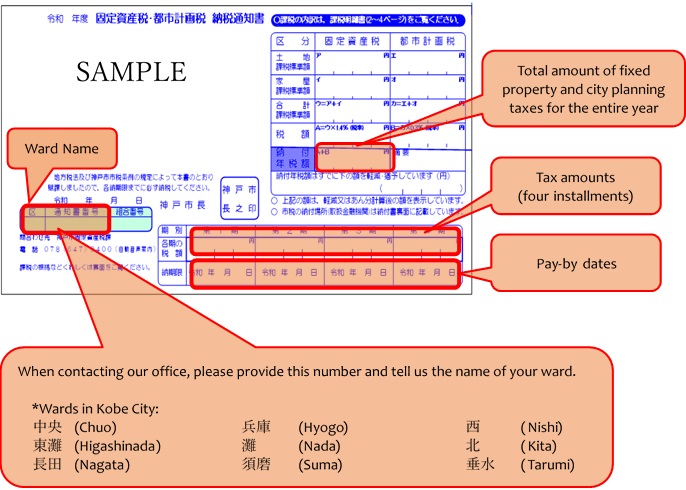

All individuals or legal entities that own land plots or houses in the city as of January 1st of each year must pay the fixed property tax. For assets located in urban zones (those with many residential and commercial facilities), you will also need to pay the city planning tax.

ABOUT THE TAX PAYMENT PROXY

Individuals or legal entities that are obligated to pay municipal taxes but do not have a valid residential or business address in Kobe city should appoint a tax payment proxy, who will carry out tax-related procedures on their behalf. This person will receive your tax notices and then pay your taxes instead of you. If you would like to appoint or change a tax payment proxy, please fill out the following form and mail it to the address provided below.

- NOTIFICATION OF APPOINTMENT/CHANGE OF TAX PAYMENT PROXY (Proxy in Kobe)(PDF:208KB)

- CONSENT/CHANGE OF TAX PAYMENT PROXY REQUEST (Proxy outside of Kobe)(PDF:246KB)

- SAMPLE(PDF:239KB)

Change of Address Notification Form for Receiving Tax Notices

If you would like to change the address of receiving tax notice, please fill out the following form and mail it to the address provided below.

Change of Address Notification Form for Receiving Tax Notices(PDF:63KB)

SAMPLE(English) (PDF:165KB)

Contact information for the department in charge of fixed property and city planning tax

| MAILING ADDRESS | |

|---|---|

| koteishisanzeika@city.kobe.lg.jp | Kobe City Fixed Property Tax Division Shin-Nagata Government Office, 4F 5-1-32 Futaba-cho, Nagata-ku, Kobe 653-0042 |

HOW TO PAY FIXED PROPERTY & CITY PLANNING TAXES

1. DOMESTIC BANK TRANSFER

If you set up a bank transfer, your taxes will be automatically withdrawn from your bank account in Japan.

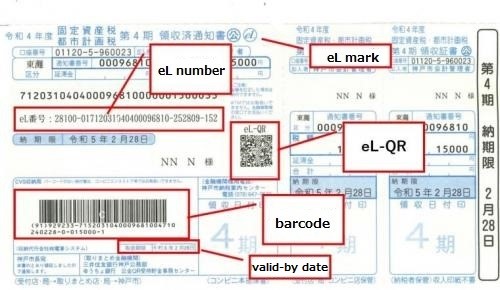

2. CASHLESS PAYMENTS

You can always pay these taxes on your computer,

smartphone or tablet device using one of the following options:

- Credit cards, Internet banking, Direct debit, Pay-easy number (ATM, etc.)

- Payment apps: Please check a list of supported apps

You can pay with eL-QR code or eL number on your tax invoice.

- Credit cards, Internet banking, Direct debit, Pay-easy number (ATM, etc.)

- Access the 「地方税お支払いサイト」.

- Scan the eL-QR code or enter the eL number on your tax invoice.

- Select a payment method and complete a payment.

- Payment apps

- Scan the eL-QR code with a payment app and check the amount of payment.

- Complete a payment.

3. USING YOUR TAX INVOICE

A tax invoice will be mailed to you along with your tax notice.

This tax invoice can be used at:

- Banks, post offices and convenience stores

- Shin-Nagata Government Office etc.

PLEASE NOTE THAT:

■ If you choose to pay using a credit card or internet banking, you will be charged a transaction fee on top of your taxes.■ If there is no barcode on your invoice, you cannot pay at convenience stores or use the payment apps.

■ If you require a receipt, please pay at a bank, post office or convenience store.

■ Your invoices will feature two separate deadlines, a “pay-by” (納期限) date and a “valid-by” (取扱期限) date. Only banks and post offices will be able to accept your invoices after the valid-by date.

If you would like us to issue a new invoice for you, please contact us at the following E-mail:

| MAILING ADDRESS | |

|---|---|

| syuno-kanri@city.kobe.lg.jp | Kobe City Tax Collection Management Division Shin-Nagata Government Office, 5F 5-1-32 Futaba-cho, Nagata-ku, Kobe 653-0042 |